Book

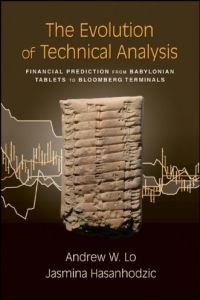

The Evolution of Technical Analysis

Financial Prediction from Babylonian Tablets to Bloomberg Terminals

Read or listen offline

Amazon Kindle

automatisch generiertes Audio

1×

Melden Sie sich an, um die Audiozusammenfassung anzuhören.

automatisch generiertes Audio

Recommendation

Finance professor Andrew W. Lo and research specialist Jasmina Hasanhodzic present a history of finance and of the development of business and stock markets. Their informative research connects the commerce of ancient times to modern practices, theories and analytical methods. getAbstract recommends this sweeping and engaging history to professionals curious about how business evolved and to students majoring in economics, finance, history or related disciplines.

Summary

About the Authors

Andrew W. Lo is a professor of finance at the MIT Sloan School of Management and the chairman of the AlphaSimplex Group, where electrical engineer and computer scientist Jasmina Hasanhodzic is a researcher.

By the same authors

Book

Comment on this summary