Join getAbstract to access the summary!

Join getAbstract to access the summary!

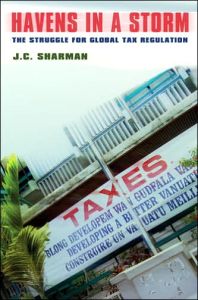

J. C. Sharman

Havens in a Storm

The Struggle for Global Tax Regulation

Cornell UP, 2006

What's inside?

Sometimes the little guy wins. How Barbados, Bermuda and other tax havens warded off the superpowers.

Recommendation

The battle seemed like a no-brainer: The world’s superpowers launched an effort to force tiny tax havens such as the Cayman Islands, Barbados and Mauritius to raise their taxes. Yet, in this contentious war of words, the underdogs prevailed. In his look at the major nations’ four-year attempt to crack down on tax havens, J.C. Sharman produces an intriguing study of what the big countries did wrong and what the small states did right. While his style is stilted at times, Sharman delivers a trenchant analysis of this high-stakes dispute and its surprising outcome. getAbstract recommends this bracing David-and-Goliath story to readers seeking perspective on the tax wars in particular and on international relations in general.

Summary

About the Author

J.C. Sharman is senior lecturer in government and international relations at the University of Sydney. He also wrote Repression and Resistance in Communist Europe.

Comment on this summary