8 things you need to know about China’s economy

Image: REUTERS/Stringer

Jonathan Eckart

Project Lead, Global Battery Alliance, Global Leadership Fellow, World Economic Forum

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

China

The Chinese economy receives a lot of interest in the media but it can be difficult to keep track of the basic facts. Here is an overview of China’s economy in the context of its global economic rise.

China was the world’s largest economy in 1820 – and is the second largest economy today

When President Monroe looked beyond the United States in the 1820s, he saw a vastly different world than the one we see today: the Greeks had just begun to revolt against the Ottoman Empire, Brazil declared independence from Portugal and the world’s first modern railway opened in England, where the first industrial revolution was already underway. Meanwhile, China, where the Qing dynasty approached its third century of imperial rule, held the largest share of global GDP.

Two-hundred years later, global economic leaders and tech experts gather in China against the backdrop of the Fourth Industrial Revolution. China is now the world’s second largest economy (and the largest if measured in PPP terms), having fallen behind from the late 19th Century onward as several industrial revolutions compounded in the Western world. But China began an unprecedented economic catch-up in 1978.

China lifted more people out of poverty than any other country

At the outset of the reforms in 1978, China was poor. It had a GDP per capita level similar to Zambia – lower than half of the Asian average and lower than two thirds of the African average. China experienced an average GDP growth of close to 10% per year until 2014, raising per capita GDP almost 49-fold, from 155 current US Dollars (1978) to 7,590 US Dollars in 2014, lifting 800 million people out of poverty – an unparalleled achievement. In urban centres in China, poverty has been virtually eliminated. However, China’s development has been driven by the coastal east, while development in the rural west is lagging behind. Its per capita income is still below the world average, showing the amount of development still to be done.

The fact that the world reached its UN millennium development goal of halving extreme poverty was largely driven by China, which accounted for more than three quarters of global poverty reduction between 1990 and 2005. Similarly, this development fuelled the ballooning of the Asian middle class that underpinned global economic convergence and a reduction of inequality between countries.

How was this achieved? China became the world’s manufacturing hub, specialising in the labour-intensive, export-led production of cheap goods that enabled a gradual increase in product complexity. In a nutshell, its growth strategy was to assemble and sell cheap goods to the world.

The starting point was unfavourable to this strategy. In 1978, three quarters of the country’s industrial production was accounted for by centrally controlled, state-owned enterprises, following centrally planned output targets. Collectivized agriculture was the norm. Under Deng’s leadership, prices were gradually liberalized (following an initial dual price system, allowing a quota and a market price), sub-national governments were granted greater fiscal autonomy coupled with incentives to attract investment and drive growth, while the private sector was also expanding. The country was opened up to trade, supported by the introduction of a closed but more modern banking system.

This impact of China’s economic progress on global poverty statistics is not surprising considering that it accounts for about 18% of the world’s population. Consider the below map, which divides the world into five regions, each of which contains the same population as China. For example, China has the same population as North and South America, Australia, New Zealand, and Western Europe combined.

China experienced a marked slow-down of GDP growth

Last year China grew at its slowest pace since 1990. In the first quarter of 2016, the country recorded a GDP growth of 6.7%. What happened? There was a strong decline in manufacturing and construction output, the main drivers of China’s growth until now. But a few other issues came into play, considering the three main ingredients for long-run growth being labour, productivity and capital.

First, China’s population peaked in 2012 and its labour force is now declining. Second, as China is catching up economically with the rest of the world and is approaching the innovation frontier, leaps in productivity can no longer stem from knowledge transfers but must increasingly be driven by domestic innovation. The contribution of total factor productivity to growth has risen from 11% before 1978 to more than 40% since then. Strong growth from a low base is normal (building basic infrastructure is a key driver) and becomes more difficult to sustain as the basics are met. Catching up is easier than pushing the innovation frontier. Such a move from investment-led growth to a productivity-led model could add 5.6 trillion US Dollars to China's GDP by 2030.

Lastly, China’s already high investment levels of around 50% of GDP will be difficult to sustain in light of total debt having reached 237% of GDP (Q1 2016), up from 148% at the end of 2007. However, domestic demand and investment are growing again, the latter at twice the speed of GDP growth in the last quarter of 2015, flowing mainly into housing and property development.

The private sector is the main driver of growth and employment

Between 2010 and 2012, private sector firms produced between two-thirds and three-quarters of China’s GDP; it also accounts for 90% of China’s exports.

As the below chart shows, the tertiary sector now makes up the majority of GDP; financial services account for more than 80% of economic profit. The tertiary sector is also the largest source of employment (36.1%), compared to 33% in agriculture and 30.3% in industry, according to the National Bureau of Statistics of China.

This is quite a recent development and part of the frequently discussed economic rebalancing that China is undertaking. Increasingly, consumption expenditure goes into services. For example, urban households spend 40% of their consumption on services such as education, health care, entertainment and travel, up from 20% 20 years ago. The consumption share of GDP has now risen for five consecutive years and accounts for 13.6 of China’s GDP. While this is a low base, the growth trend is a noteworthy change.

Services are also the most important driver of job creation. A 1% increase in services output generates one million jobs, compared to only half a million jobs created by a 1% increase in industrial output. Wages outside of the agriculture sector are typically three times higher than wages in agriculture, so all things equal this makes people better off.

China is developing middle class consumers

This growth in services is reflected in a growth in wealth and disposable household income. Chinese consumers are spending more on lifestyle services and experiences while also moving from mass to premium segments. What is more, happiness and a balanced life are increasingly prized as the Chinese middle class moves up the income ladder. Saving is still comparatively important to consumers.

Indeed, the Chinese are known to have high savings rates, which makes the shift from an export-driven to a consumption-driven economy all the more difficult. In 2014, China had a savings rate of close to 50% of GDP. Compare this for example to Chile, which falls into the same income group (upper middle) and has a gross savings rate of 22.3%. At the other end of the extreme sits the US with 14.4% savings and a consumption rate of two thirds of GDP.

The growth slow-down is dampening industrial output and State-Owned Enterprise profitability

Among the fastest growing sectors of the economy are healthcare, technology, education and entertainment – which are gaining in importance in light of China’s economic rebalancing. The growth slow-down is particularly affecting heavy industries such as steel, coal and cement – sectors of strategic importance to the central government in which state-owned enterprises (SOEs) are clustered.

These sectors are now showing over-capacity and low productivity. Since the 1990s, SOEs have been consolidated through closures and mergers but this down-sizing came to a halt in 2007-2008 when the government rolled out a stimulus programme to cushion the effects of the global financial crisis and finance went into factory constructions and equipment without the demand to meet this supply.

SOEs are less profitable than private companies and the share of loss-making SOEs has been rising since 2010. Bankruptcies have begun to surge again this year in an attempt to target unprofitable companies, however mostly involving small and medium-sized enterprises.

China is the world’s largest exporter and the second largest importer of merchandise goods

China has a substantive bearing on global economic performance. Since 2010, it’s the world’s largest exporter and second-largest importer of merchandise goods, as well as the fifth largest exporter and third largest importer of commercial services. The below figure visualises China’s trade with countries across the world.

The main destinations are the US (17%), the European Union (15.9%), Hong Kong (15.5%), Japan (6.4%) and the Republic of Korea (4.3%). Ninety-four percent of all merchandise exports are manufactured goods, 3.2% agricultural products and 2.7% fuel and mining products.

China is the second largest provider and the top receiver of foreign direct investment (FDI)

As the below charts show, China is among the largest providers and receivers of foreign direct investment (FDI). Last year alone, FDI outflows from China jumped by 15% from the previous year and reached 116 billion US Dollars. The US, by comparison, had a total outflow of 337 billion US Dollars in FDI (a 3% rise).

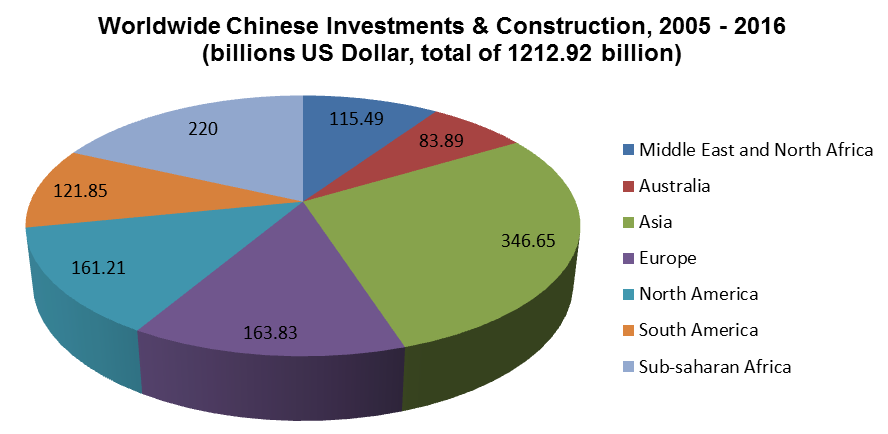

China also has the world’s largest foreign exchange reserves of 3.21 trillion US Dollars. Furthermore, between 2005 and 2016 China’s total global investment and construction activities amounted to a value of about 1.2 trillion US Dollars. As the pie chart shows, the largest part of this share went to Asia, followed by sub-Saharan Africa, Europe and North America.

A big part of this investment comes in the form of development finance. Beijing’s ascent on the African investment landscape has been frequently documented, and its intended revamp of the Silk Road (“one belt one road”) is cause for hope to spark inclusive growth and development across Central Asia. In Latin America it has outstripped the loans given by the World Bank and the Inter-American Development Bank combined.

It may then not come as a surprise that China has doubled the available financial capital for development finance globally over the past decade and accounts for more such loans than the world’s six major multilateral institutions combined.

China has a clear path forward

By 2030 China is expected to be the world’s largest economy once again. As the overview shows, obstacles await, such as facilitating domestic consumption and lower savings, reducing debt levels, reforming the SOE sector and realising a balanced and healthy rise in prosperity with growing living standards for all. Yet the country is on its way to reclaim its position as the world’s largest economy amid the Fourth, not the First, Industrial Revolution.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Geographies in DepthSee all

Andrea Willige

April 23, 2024

Libby George

April 19, 2024

Apurv Chhavi

April 18, 2024

Efrem Garlando

April 16, 2024

Babajide Oluwase

April 15, 2024

Rida Tahir

April 9, 2024