Join getAbstract to access the summary!

Join getAbstract to access the summary!

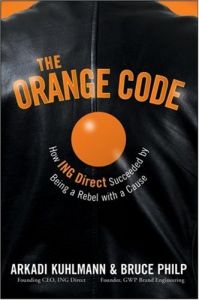

Arkadi Kuhlmann and Bruce Philp

The Orange Code

How ING Direct Succeeded by Being a Rebel with a Cause

Wiley, 2008

What's inside?

ING Direct’s founders offer an upbeat inside report on how they developed their unique brand and why.

Recommendation

To say that ING Direct is not a traditional bank is a gross understatement. Most banks offer a bewildering multitude of financial products accompanied by add-on fees. Not ING Direct. It focuses on one thing: saving money in simple, high-interest savings accounts. Traditional banks operate from formal offices with tellers behind bullet-resistant glass and managers seated in cubicles, but ING Direct conducts much of its banking business from sleek cafés that offer coffee and luxury brands of tea. In each of its branches in the U.S., Canada, the U.K. and Australia, it offers customers light snacks, free computer stations, conversation-zone seating and kitschy ING Direct merchandise. In this book, two imaginative business geniuses, Arkadi Kuhlmann, ING Direct’s iconoclastic “CEO of Savings,” and Bruce Philp, co-founder of GWP Brand Engineering, the firm’s marketing agency, explain how they started this innovative “un-bank,” how it operates and what its guiding principles are. Perhaps no institution could be quite as rosy as this insider-written corporate bio suggests, but if you want to shake things up in your corner of the professional world, getAbstract suggests this idiosyncratic book about a bright, bold business.

Summary

About the Authors

Arkadi Kuhlmann is the founding CEO of ING Direct USA. He is a former professor of international finance and investment banking. Bruce Philp is the founding chairman of GWP Brand Engineering. He is an expert on corporate branding.

Comment on this summary