Join getAbstract to access the summary!

Join getAbstract to access the summary!

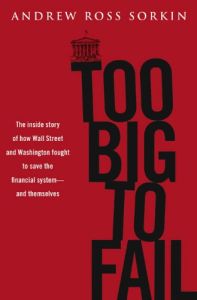

Andrew Ross Sorkin

Too Big to Fail

The Inside Story of How Wall Street and Washington Fought to Save the Financial System from Crisis – and Lost

Viking, 2009

What's inside?

Expert, step-by-step examination of how Paulson, Geithner, Dimon and Fuld navigated the collapse of 2008.

Recommendation

The ever-growing pile of books about the Great Recession holds two kinds of tomes: those that pontificate about what went wrong and what should change, and those that detail the minute-by-minute action in the boardrooms of Wall Street and Washington. This book is the second kind. New York Times reporter Andrew Ross Sorkin, who gained access to many high-level financial players, provides an ambitious, remarkably detailed account of the collapse and bailouts of 2008. He accomplishes two noteworthy feats: He digs up information that wasn’t widely known, and he beautifully writes a page-turning yarn. getAbstract recommends his book to investors, policy makers and businesspeople who seek a clear observer’s perspective on Wall Street’s meltdown.

Summary

About the Author

Andrew Ross Sorkin is the chief mergers-and-acquisitions reporter and columnist for The New York Times. He founded DealBook, an online daily financial report.

Comment on this summary