Join getAbstract to access the summary!

Join getAbstract to access the summary!

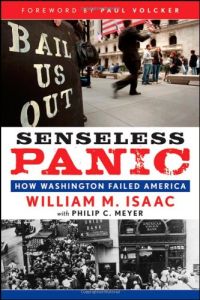

William M. Isaac and Philip C. Meyer

Senseless Panic

How Washington Failed America

Wiley, 2010

What's inside?

A sharp critique of the 2008 federal TARP program, chronicling mismanagement, waste and failure

Recommendation

In his first-person account comparing the 1980s bank crisis to the 2008 financial panic, William M. Isaac excoriates government officials for needlessly stoking fear and costing taxpayers billions of dollars through the Troubled Asset Relief Program (TARP). Isaac, the former head of the Federal Deposit Insurance Corporation (FDIC), navigated that agency through the 1980s bank and thrift debacle, and he voices sharp opinions on the TARP’s shortcomings, politicization and mismanagement. His presentation details how the government (read the FDIC) could have prevented this entire systemic mess had it responded as it had in the ’80s under his lead. Unfortunately, most of Isaac’s remedies are bank-centric and thus gloss over the roles nonbank financial institutions played in the 2008 crisis. He also doesn’t acknowledge any of the experts who say TARP ultimately succeeded in many ways. Nonetheless, getAbstract suggests this book for its well-informed treatment of the 2008 crisis in the context of recent bank history.

Summary

About the Authors

Former FDIC chairman William M. Isaac is currently chairman of LECG Global Finances Services. Philip C. Meyer is a government affairs consultant.

Comment on this summary