Join getAbstract to access the summary!

Join getAbstract to access the summary!

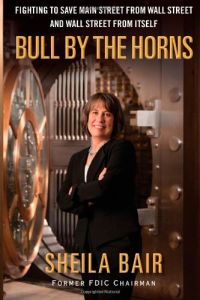

Sheila Bair

Bull by the Horns

Fighting to Save Main Street from Wall Street and Wall Street from Itself

Free Press, 2012

What's inside?

One woman took on Wall Street old boys’ club and now she’s naming names.

Recommendation

Former Federal Deposit Insurance Corporation (FDIC) chief Sheila Bair holds nothing back in her assessment of Wall Street, Washington, and the internecine politics and conflicting agendas shared by regulators, lawmakers, bankers and politicians. She is plainspoken, candid, and not one of the boys. In office, this made her the subject of rumors and misinformation and earned her a reputation as “difficult.” Now she calls out the combatants, making little show of objectivity, given that this is her side of the saga. Smart and strong, she doesn’t bother with ladylike niceties, describing one financial CEO as a “country bumpkin” and another as not “up to the job,” though she credits a luckier financier with “puckish charm and quick wit.” getAbstract recommends this illuminating insider’s view of the Wall Street-Washington nexus for its revealing narrative and unnerving conclusion: Nothing will change unless Main Street makes it happen.

Summary

About the Author

Sheila Bair served as head of the Federal Deposit Insurance Corporation from 2006 to 2011. Time magazine named her one of the “100 Most Influential People” in 2009; Forbes twice hailed her as the “second most powerful woman in the world.”

Comment on this summary