Join getAbstract to access the summary!

Join getAbstract to access the summary!

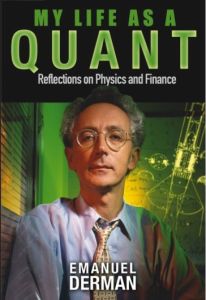

Emanuel Derman

My Life as a Quant

Reflections on Physics and Finance

Wiley, 2004

What's inside?

Physicist Emanuel Derman underwent wrenching career changes, but shaped the future of Wall Street analysis and academia.

Recommendation

This excellent autobiography covers the emotional life of a thoughtful man. Emanuel Derman examines his conscience dispassionately and honestly, offering a sometimes poignant account of his descent from the world of pure science to the hustle of Wall Street. His memoir flows like a conversation, albeit with many tangents. You’ll learn more than you want about personnel changes at his former firms, but you’ll also gain rare insights into how Wall Street makes decisions, plus a few excellent points about the inadequacy of financial theory as science. Derman’s descriptions of options theory and financial models sometimes approach clarity, but may be far beyond the lay reader’s understanding. getAbstract recommends this book to avid students of Wall Street and to any academic contemplating a move there. General readers who would enjoy Derman’s reminiscences, and who do not mind tackling some dense scientific and financial material, will find an in-depth life story with moving reflections on the disparity between youthful ideals and mature compromises.

Summary

About the Author

Emanuel Derman is director of the financial engineering program at Columbia University, a columnist for Risk magazine and a risk advisor to an investment management company. He holds his Ph.D. in theoretical physics from Columbia, and is co-author of the Black-Derman-Toy interest rate model and the Derman-Kani local volatility model.

Comment on this summary