Join getAbstract to access the summary!

Join getAbstract to access the summary!

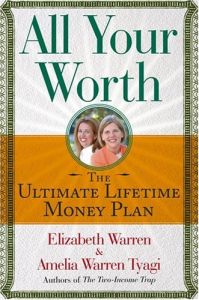

Elizabeth Warren and Amelia Warren Tyagi

All Your Worth

The Ultinate Lifetime Money Plan

Free Press, 2005

What's inside?

How to find perfect financial balance: half for necessities, 30% for desirables, 20% for savings. Step one: start now.

Recommendation

Authors Elizabeth Warren of Harvard Law School’s faculty and her daughter Amelia Warren Tyagi, a Wharton School of Business graduate, veer away from the usual save-your-pennies, clip-your-coupons genre of financial advice. They are less interested in teaching you how to pinch pennies than in showing you insightful ways to reclaim your life from your creditors and establish a sense of financial well-being. In fact, they warn that penny-pinching can be a dangerous distraction. The solution to out-of-control debt, they say, is a balanced approach, which begins by trimming the big-ticket budget busters that are devouring your income. The authors go beyond soft anecdotes and generalities to delineate specific tactics for plugging the holes in your finances, supported by diagnostic tests for readers. Occasionally their writing style is awkward - such as when they relate first-person anecdotes by specifying in parentheses which author is telling the story - but the book is otherwise lucid. The content reflects extensive, resourceful research. Best of all, the authors are realistic and don’t promise any quick fixes. getAbstract.com strongly recommends this volume to anyone who needs financial guidance - and considering that U.S. banks alone will earn more than $100 billion this year in credit card interest, fees and other charges, that should include plenty of readers.

Summary

About the Authors

Elizabeth Warren and Amelia Warren Tyagi are the mother and daughter finance team who co-authored The Two-Income Trap. Warren is a professor at Harvard Law School. Her daughter, Tyagi, a financial consultant with a Wharton M.B.A., has written numerous articles. The authors often appear together on television.

Comment on this summary