Join getAbstract to access the summary!

Join getAbstract to access the summary!

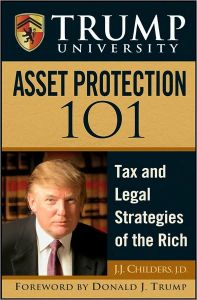

J. J. Childers

Trump University Asset Protection 101

Tax and Legal Strategies of the Rich

Wiley, 2007

What's inside?

Find out how you can protect the proceeds of your lifetime of work from taxes and lawsuits.

Recommendation

Donald Trump has branded a core set of texts on personal finance that will probably sell quite well thanks to the power of his imprimatur. In that role, Trump has provided a generic two-paragraph foreword for all the books in this series. The author, J.J. Childers, offers a good basic text that explains the whys and hows of arranging assets to protect them from lawsuits and taxes, particularly estate taxes, in the U.S. He also discusses how to keep more money by structuring your wealth properly. This is all great advice, but the book’s real value is that it makes you aware of these basic personal finance concepts, and gets you strategizing clearly about how to hang on to – and protect – your earnings. getAbstract finds some good advice in this primer on asset protection, though you may want to supplement it with more advanced materials as you develop a deeper understanding of this important subject.

Summary

About the Author

J. J. Childers, J.D., is an attorney and speaker who specializes in asset protection strategies.

Comment on this summary