Recommendation

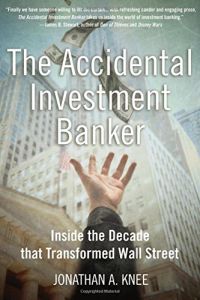

Whenever there are dramatic upheavals on Wall Street, shock waves ricochet throughout the U.S. and world economies. And, when you say Wall Street, most people think of its storied investment banks – Morgan Stanley, Goldman Sachs, J.P. Morgan Chase. Who built and ran these firms? What makes them tick? How did they fare in the booming 1990s? And what is happening to them (at least, what was happening just before the autumn 2008 crackup). Investment banker Jonathan A. Knee, a Goldman Sachs and Morgan Stanley alumnus, reports on his career and on the investment banking industry. He explains how these firms have changed radically from the days when J.P. Morgan Jr. advised his peers to do “first-class business in a first-class way” to the Wall Street motto of the 1990s, “IBG-YBG” (“I’ll be gone, you’ll be gone”), meaning, “Who cares what happens long-term regarding the deals we do today?” This shockingly shortsighted viewpoint led to the recent bitter harvest. If you want to understand how Wall Street works – and sometimes doesn’t work – getAbstract recommends this informative, insightful and witty book.

Summary

About the Author

Jonathan A. Knee is an adjunct professor of finance and economics at the Columbia Graduate School of Business, and senior managing director of Evercore Partners’ corporate advisory practice.

Comment on this summary