Join getAbstract to access the summary!

Join getAbstract to access the summary!

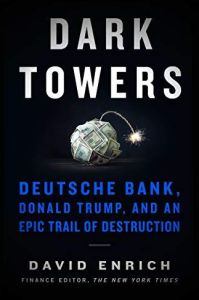

David Enrich

Dark Towers

Deutsche Bank, Donald Trump, and an Epic Trail of Destruction

Custom House, 2020

What's inside?

Scams, money laundering, dubious deals – throughout its messy history, Deutsche Bank has done it all.

Recommendation

You would think that by now journalists would have plumbed every possible angle of the secretive world of global finance. Not quite, as this riveting tome by The New York Times’ David Enrich shows. In his telling, German financial giant Deutsche Bank is a deeply dysfunctional institution, one that rarely turns down credit to a flimflam artist or declines an opportunity to run afoul of banking regulations. Enrich details a century-plus of bad loans, shady dealings and a relationship with a US president that’s rife with conflicts of interest. Derivatives and refinancing aren’t usually the stuff of page-turners, but Enrich digs up the most suspenseful material and keeps you engrossed all the while.

Summary

About the Author

David Enrich is the finance editor at The New York Times. He previously was an editor and reporter at The Wall Street Journal.

Comment on this summary