Join getAbstract to access the summary!

Join getAbstract to access the summary!

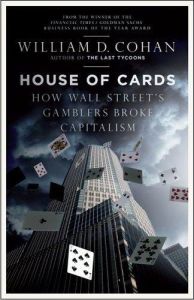

William D. Cohan

House of Cards

How Wall Street`s Gamblers Broke Capitalism

Allen Lane, 2009

What's inside?

The inside story of Bear Stearns’s rapid plunge from profitability to failure amid Wall Street’s downhill slide.

Recommendation

The 2008 collapse of leading Wall Street investment house Bear Stearns showed the world just how rickety the global financial system had become. William D. Cohan tracks the firm’s dizzying rise and rapid collapse. His access to Bear Stearns insiders is the book’s strongest point. He offers a trenchant analysis of its decades-long rise and a definitive account of its final days. Cohan paints textured portraits of Bear’s top people, though he isn’t especially interested in translating their Wall Street jargon for lay readers. He lets his sources speak in their own patois. getAbstract recommends this book to business history buffs, investors and managers seeking perspective on a spectacular failure.

About the Author

William D. Cohan, former senior Wall Street investment banker, is the author of the New York Times bestsellers House of Cards and The Last Tycoons. That book also received the Financial Times Goldman Sachs Award. He writes for the Financial Times, The Atlantic, The New York Times and The Washington Post and is a contributing editor to Fortune magazine.

Comment on this summary