Join getAbstract to access the summary!

Join getAbstract to access the summary!

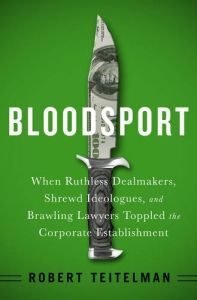

Robert Teitelman

Bloodsport

When Ruthless Dealmakers, Shrewd Ideologues, and Brawling Lawyers Toppled the Corporate Establishment

Public Affairs, 2016

What's inside?

With the takeover wars of the 1980s, American business entered an era of complexity and instability.

Recommendation

Business journalist Robert Teitelman offers an in-depth, eminently readable account of the takeover tsunami that engulfed Wall Street and corporate America in the 1980s. With dry wit and an eye for vivid detail, Teitelman tours the decade’s smoking battlefield of mergers, leveraged buyouts and hostile takeovers. He reports on the University of Chicago’s free market economists, who provided a rationale for unrestrained takeovers and influenced the regulatory stance of President Ronald Reagan’s administration. Teitelman also explains how deal mania realigned corporate governance away from the “stakeholder model” – in which managers ran companies for the benefit of employees, customers, shareholders and the community – to the “shareholder model” – in which only stock owners’ profits mattered. getAbstract recommends this enlightening history to students of business and of business reporting, as well as to aspiring M&A specialists.

Summary

About the Author

Robert Teitelman, founding editor in chief of The Deal and former editor of Institutional Investor, is a freelance editor and writer for Institutional Investor, Barron’s and private clients.

Comment on this summary