Join getAbstract to access the summary!

Join getAbstract to access the summary!

S&P Global Market Intelligence

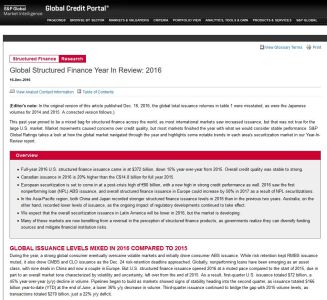

Global Structured Finance Year In Review: 2016

Standard & Poor's, 2016

What's inside?

Global structured finance markets provided an assortment of positives and negatives in 2016.

Recommendation

Structured finance markets, consisting of complex collateralized securities, shrank in issuance volumes in 2016, due largely to declines in the United States. But the downdraft did not cover all geographies or product lines. Investment professionals at S&P Global Market Intelligence dissect and scrutinize global structured finance markets’ 2016 performance and 2017 prospects. getAbstract recommends their robust analysis to investors and market participants interested in assessing the condition of the world’s securitization markets.

Summary

About the Author

Standard & Poor’s is a global rating agency and a research and analysis organization

Comment on this summary