Join getAbstract to access the summary!

Join getAbstract to access the summary!

Galina Hale, Arvind Krishnamurthy, Marianna Kudlyak and Patrick Shultz

How Futures Trading Changed Bitcoin Prices

FRBSF, 2018

What's inside?

Bitcoin’s massive price gyrations have left investors feeling dizzy.

Recommendation

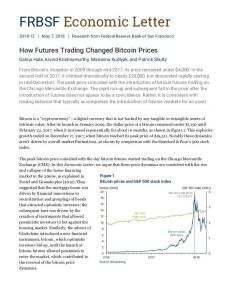

With cryptocurrencies the latest speculative rage, traders in 2017 pushed bitcoin from less than $1,150 to almost $20,000 in a matter of months. But after hitting fresh highs, bitcoin’s price reversed and plummeted in early 2018. Economists Galina Hale, Arvind Krishnamurthy, Marianna Kudlyak and Patrick Shultz examine this phenomenon in the context of bitcoin futures trading that began in December 2017. While it never gives investment advice, getAbstract recommends this informative report to investors and traders interested in bitcoin’s ups and downs.

Summary

About the Authors

Galina B. Hale, Marianna Kudlyak and Patrick Shultz are researchers at the Federal Reserve Bank of San Francisco. Arvind Krishnamurthy is a finance professor at the Stanford Graduate School of Business.

Comment on this summary