Join getAbstract to access the summary!

Join getAbstract to access the summary!

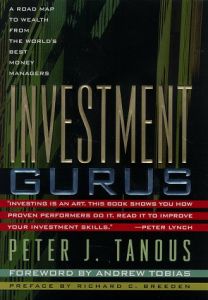

Peter Tanous

Investment Gurus

A Road Map to Wealth from the World's Best Money Managers

FT Prentice Hall, 1997

What's inside?

Four hundred pages of investment information straight from the mouths of some very important horses.

Recommendation

Peter Tanous features interviews with 18 individuals he identifies as top, common stock investment consultants - or "gurus." His choices are based on his work as a consultant identifying investment advisers for corporations. The consultants he selected for this book represent the major stock investing approaches as growth, value or momentum investors. The interview format lets them speak for themselves. He briefly introduces the book with a primer on basic investment terms and principles, and a summary of major themes. getAbstract finds the range of views shown very helpful, but notes that the book suffers from overwriting and a lack of focus and editing. Some tightening would help highlight the main points in the long interviews. The introduction and conclusion are long and general, and a clearer, more detailed summary would be very welcome. Yet, the book offers a lot of information for the average serious investor, much of it straight from the mouths of some very important horses.

Summary

About the Author

Peter J. Tanous , a Washington, D.C., registered investment advisor, is President of Lynx Investment Advisory, Inc. He provides consulting services to institutions and individuals on how to select and monitor a money manager. Before founding Lynx, Tanous was Executive Vice President and a director of Bank Audi (USA) in New York City.

Comment on this summary