Join getAbstract to access the summary!

Join getAbstract to access the summary!

Brendan Greeley

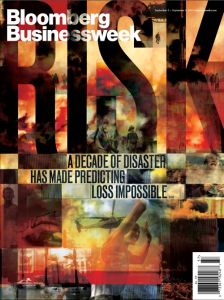

The God Clause and the Reinsurance Industry

The risk business can tell us a lot about catastrophes. Why don't we listen?

Bloomberg Businessweek , 2011

What's inside?

What if the worst thing you can imagine is not the worst thing that can actually happen? Trouble for the reinsurance industry.

Recommendation

Few people work directly with reinsurance, so it may seem an oddity. However, since reinsurers work at estimating the likelihood of disasters, and their work underpins insurance, they affect everyone. What reinsurance has and hasn’t been able to predict has gotten more complicated in this age of global terrorism and climate change which has far-reaching ramifications. getAbstract suggests this article to all grappling with the implications of global change, and, specifically, to readers seeking to understand risk.

Summary

About the Author

Brendan Greeley is a staff writer for Bloomberg Businessweek.

Comment on this summary