Join getAbstract to access the summary!

Join getAbstract to access the summary!

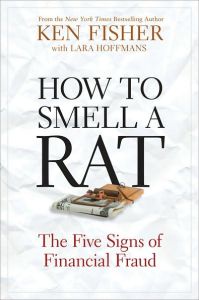

Ken Fisher and Lara Hoffmans

How to Smell a Rat

The Five Signs of Financial Fraud

Wiley, 2009

What's inside?

How to circumvent the financial fraudsters and con artists who are eagerly waiting to take your money.

Recommendation

The unlamented year of 2008 was a terrible time for investors. The news that money wizard Bernie Madoff stole some $65 billion from his investment clients with a giant pyramid scheme added insult to injury. Though already in his 70s, Madoff received a 150-year prison sentence for his thievery. Many felt the punishment was too light. The world is full of crooks and charlatans like Madoff. Fortunately for investors, they often give themselves away if you know how to spot them. In this savvy manual, business journalist Ken Fisher (writing with investment expert Lara Hoffmans) details five warning signs that can reveal crooks posing as financial advisers. getAbstract recommends this book to investors who are suspicious and to those who ought to be.

Summary

About the Authors

Ken Fisher, author of Forbes magazine’s Portfolio Strategy column, is the founder, chairman and CEO of a money management firm. Lara Hoffmans is an investment firm executive and a contributing editor for MarketMinder.com.

Comment on this summary