Join getAbstract to access the summary!

Join getAbstract to access the summary!

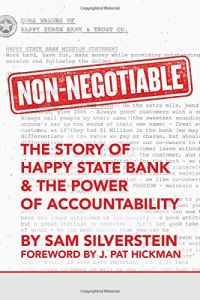

Sam Silverstein

Non-Negotiable

The Story of Happy State Bank & The Power of Accountability

Sound Wisdom, 2015

What's inside?

The people of Happy State Bank follow 20 “non-negotiable” principles for success and spiritual and moral health.

Recommendation

A special financial institution serves 23 Texas Panhandle communities: the Happy State Bank. The bank operates according to a distinctive code of conduct, written in the form of 20 standards, or “non-negotiable” principles that all employees must honor. Organizational accountability expert Sam Silverstein describes the bank’s culture. He explains how its non-negotiable standards give it an ideal framework for success and why your employees may need non-negotiable principles as well to attain a high level of accountability. This bank is an unusual organization, and its CEO is an unforgettable personality. Unhappily, Silverstein proves a repetitive storyteller who oddly trademarks common phrases, such as “The Power of Accountability.” Even so, getAbstract recommends his inside look at Happy State Bank to those seeking to live responsible lives and to hold themselves and their companies fully accountable.

Summary

About the Author

National Speakers Association past president Sam Silverstein is founder and CEO of Sam Silverstein Inc., an organizational accountability think tank.

Comment on this summary