Join getAbstract to access the summary!

Join getAbstract to access the summary!

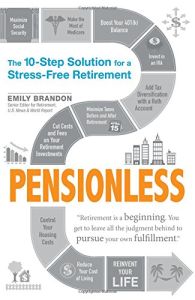

Emily Brandon

Pensionless

The 10-Step Solution for a Stress-Free Retirement

Adams Media, 2016

What's inside?

Retirement planning expert Emily Brandon offers 10 steps Americans can take to plan for life after work.

Recommendation

Emily Brandon, US News & World Report’s retirement planning expert, tells US workers how to plan for retirement. Americans once could rely on pensions from the companies where they worked. They also had monthly US Social Security checks from funds they paid to the government over their working lives. Today, unless some measure replenishes Social Security, Brandon says the government won’t be able to pay full benefits after 2034. US workers who fail to plan ahead and maximize savings may end up in trouble. Given all that, she spells out 10 productive, detailed steps people can take to get ready for retirement. getAbstract recommends her knowledgeable, helpful manual to older Americans who want to enjoy life after work.

Summary

About the Author

A senior editor at US News & World Report, Emily Brandon covers retirement planning.

Comment on this summary

How's Europe doing in this?