Article

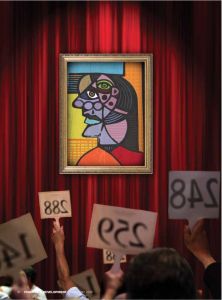

The Art of Money Laundering

The loosely regulated art market is rife with opportunities for washing illicit cash

IMF,

2019

Read or listen offline

Amazon Kindle

auto-generated audio

1×

Log in to listen to the audio summary.

auto-generated audio

Recommendation

Because the market for fine art and antiquities is secretive and largely unsupervised, it is a haven in which criminals can easily launder their ill-gotten gains – to the tune of an estimated $3 billion in 2018. In this concise and illuminating article, journalist Tom Mashberg paints a colorful picture of what is largely the last unregulated financial market in the world.

Summary

About the Author

Tom Mashberg is a syndicated journalist who writes about crimes in art and rare artifacts.

Comment on this summary