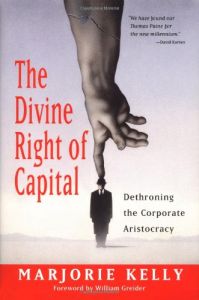

The Divine Right of Capital

Dethroning the Corporate Aristocracy

Recommendation

In The Divine Right of Capital, Marjorie Kelly has written a thoughtful, somewhat revolutionary book questioning the basic paradigm of corporate capital: maximizing shareholders’ earnings. She compares stockholders who own corporate wealth to feudal European aristocracy as she contends that the current system bestows riches on owners - who add little value to the company - while the employees do all the work. She focuses on this argument despite recent history, during which managers have extracted more value from companies than owners. Her book is a fascinating, clearly written and cogently argued attack, although she repeats some of the central points. Kelly covers the six principles that uphold the economic aristocracy and the six qualities needed to shift to the economic democracy she advocates. While getAbstract.com doesn’t agree with Kelly’s philosophy, we suspect that her lively book will intrigue economists, academics and others who like to contemplate the way whole systems function, whether for good or ill.

Summary

About the Author

Marjorie Kelly is the cofounder and publisher of Business Ethics, a national publication on corporate social responsibility. She has written for many publications, including The Utne Reader, The Progressive Populist, Tikkun, Earth Island Journal and Hope magazine, and writes a weekly column in her home town newspaper, the Minneapolis Star-Tribune. Her work has also been included in half a dozen books, including The New Entrepreneurs and The New Paradigm in Business. She has been featured in The Wall Street Journal and interviewed frequently on National Public Radio and other radio networks.

Comment on this summary