Join getAbstract to access the summary!

Join getAbstract to access the summary!

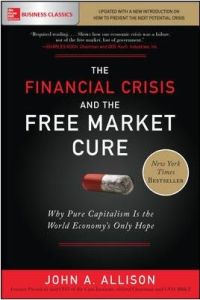

John A. Allison

The Financial Crisis and the Free Market Cure

Why Pure Capitalism Is the World Economy’s Only Hope

McGraw-Hill, 2018

What's inside?

Some think capitalism is fatally flawed, but former bank CEO John A. Allison says that’s wrong.

Recommendation

Following the 2008 financial crisis, many found the perfect scapegoat in Wall Street, whose lust for profit, they believe, nearly destroyed the economy and upended the lives of ordinary Americans. John Allison, a former CEO of BB&T Bank, disputes that notion, arguing that misguided government policy led to the collapse and weak recovery. According to Allison, only unfettered free markets can bring long-term prosperity, a point of view gained from his time as leader of a large bank holding company. While some may find his arguments often rambling, with many dizzying leaps in logic, Allison does make points worth considering about too-big-to-fail institutions and the plight of small US community banks.

Summary

About the Author

John A. Allison, CEO of BB&T from 1987 to 2010, is a director of Moelis & Company.

Comment on this summary