Join getAbstract to access the summary!

Join getAbstract to access the summary!

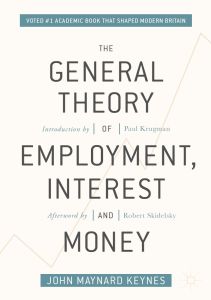

John Maynard Keynes

The General Theory of Employment, Interest, and Money

Palgrave Macmillan, 2008

What's inside?

The 2008 financial crisis and Great Recession made Keynes’s General Theory relevant again.

Recommendation

In 1936, amid the Great Depression, John Maynard Keynes transformed economics with this classic and still controversial work. He argues vigorously for strong government action to correct the excesses of laissez-faire capitalism. Some experts say that many of his lessons left the collective consciousness as neoclassical economics spread, beginning in the 1970s. But since the 2008 financial crisis and Great Recession, insights from Keynes’s original ideas are gaining renewed attention. Whether or not you understand – or accept – every idea here, take heart: According to one-half of the world’s top economists, the other half doesn’t completely understand or accept this book, either.

Summary

About the Author

John Maynard Keynes [1883–1946] was arguably the most influential economist of the 20th century. He is known as the founder of modern macroeconomics.

Comment on this summary