Join getAbstract to access the summary!

Join getAbstract to access the summary!

Eric Rosenbaum

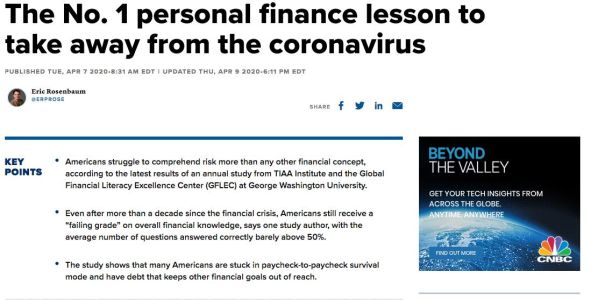

The No. 1 Personal Finance Lesson to Take Away from the Coronavirus

CNBC, 2020

What's inside?

Americans continue to receive a “failing grade” in financial literacy.

Recommendation

The 2020 annual study by the TIAA Institute and the Global Financial Literacy Excellence Center reveals that Americans continue to receive a “failing grade” in financial literacy. According to this timely article from CNBC editor Eric Rosenbaum, the survey underscores the need for greater financial education, starting at a young age. As the negative economic effects of the coronavirus pandemic continue to unfold, it’s now become more important than ever that many more Americans acquire proper money management skills.

Summary

About the Author

Eric Rosenbaum is an editor at CNBC, specializing in financial and business journalism.

Comment on this summary