Join getAbstract to access the summary!

Join getAbstract to access the summary!

Michael Smolyansky, Gustavo A. Suarez and Alexandra M. Tabova

U.S. Corporations' Repatriation of Offshore Profits

Federal Reserve Board, 2018

What's inside?

US firms are bringing back billions in overseas profits, but how are they using this capital?

Recommendation

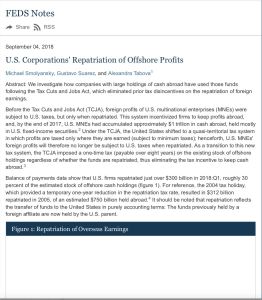

Corporate leaders have responded to the 2017 US Tax Cuts and Jobs Act with a wave of capital repatriation from overseas, bringing back in just the first three months of 2018 almost one-third of the $1 trillion in foreign-earned assets stashed abroad. Economists Michael Smolyansky, Gustavo Suarez and Alexandra Tabova examine the repatriation boom and how businesses are currently deploying this capital in an insightful report for company executives and tax policy experts.

Summary

About the Authors

Michael Smolyansky, Gustavo Suarez and Alexandra Tabova are economists with the Board of Governors of the Federal Reserve.

Comment on this summary