Зарегистрируйтесь на getAbstract, чтобы получить доступ к этому краткому изложению.

Зарегистрируйтесь на getAbstract, чтобы получить доступ к этому краткому изложению.

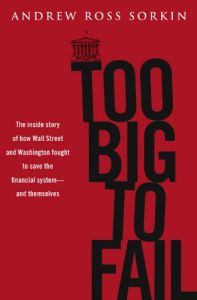

Andrew Ross Sorkin

Too Big to Fail

The Inside Story of How Wall Street and Washington Fought to Save the Financial System from Crisis – and Lost

Viking, 2009

Что внутри?

Expert, step-by-step examination of how Paulson, Geithner, Dimon and Fuld navigated the collapse of 2008.

Recommendation

The ever-growing pile of books about the Great Recession holds two kinds of tomes: those that pontificate about what went wrong and what should change, and those that detail the minute-by-minute action in the boardrooms of Wall Street and Washington. This book is the second kind. New York Times reporter Andrew Ross Sorkin, who gained access to many high-level financial players, provides an ambitious, remarkably detailed account of the collapse and bailouts of 2008. He accomplishes two noteworthy feats: He digs up information that wasn’t widely known, and he beautifully writes a page-turning yarn. getAbstract recommends his book to investors, policy makers and businesspeople who seek a clear observer’s perspective on Wall Street’s meltdown.

Summary

About the Author

Andrew Ross Sorkin is the chief mergers-and-acquisitions reporter and columnist for The New York Times. He founded DealBook, an online daily financial report.

Comment on this summary