Melden Sie sich bei getAbstract an, um die Zusammenfassung zu erhalten.

Melden Sie sich bei getAbstract an, um die Zusammenfassung zu erhalten.

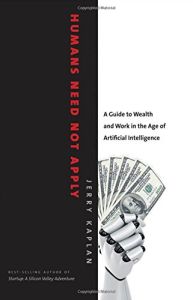

Jerry Kaplan

Humans Need Not Apply

A Guide to Wealth and Work in the Age of Artificial Intelligence

Yale UP, 2015

Was ist drin?

This intriguing analysis of the artificial intelligence revolution gives cause for caution.

Recommendation

Today’s phenomenal acceleration in computing power and machine learning and the breakthroughs in sensor acuity herald an age of artificially intelligent systems and robotic devices. Futurist Jerry Kaplan sees both great promise and grave danger in these technologies. They give people free time for creativity and caring and offer prosperity, safer transport and easier living. Conversely, as its owners profit, machine intelligence threatens jobs and current skill sets. Kaplan envisions a future of legally constituted, asset-holding “artificial persons.” His clear, fast-paced and intriguing report is a cogent heads-up on smart automation. getAbstract recommends his timely evaluation of the gathering storm of synthetic intelligence to entrepreneurs, futurists, business professors and students, CEOs, managers, the self-employed, policy makers and opinion leaders.

Summary

About the Author

Entrepreneur, inventor and futurist Jerry Kaplan, PhD, worked at Stanford University’s Artificial Intelligence Lab and teaches ethics and the philosophy of artificial intelligence at Stanford. He also wrote the best-selling Startup: A Silicon Valley Adventure.

Comment on this summary