Nathaniel Popper

Move Over, Bitcoin. Ether Is the Digital Currency of the Moment.

The New York Times, 2017

What's inside?

Will ether overtake bitcoin as the dominant digital money?

Recommendation

In yet another manifestation of the digital revolution, virtual monies such as ether and bitcoin are gaining popularity and taking off in the absence of any government oversight. Speculators are watching and betting on such currencies as well. In this informative article, New York Times journalist Nathaniel Popper provides a fascinating account of how ether is gaining on bitcoin in the quest to be the virtual currency of choice. getAbstract recommends this succinct overview to regulators, investors and others interested in how the virtual currency realm is unfolding.

Take-Aways

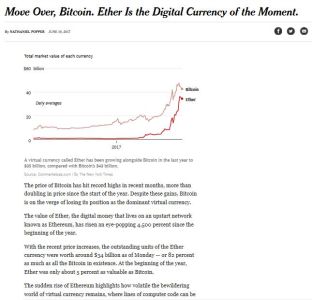

- The value of bitcoin, the leading virtual currency, rose more than 100% in the first six months of 2017. But its rival, ether, skyrocketed 4,500% over the same period.

- Volunteers, paid in digital tokens, create and sustain virtual currencies entirely on computer networks. Governance of these markets rests with investors and developers.

- Bitcoin has established some legitimacy through its acceptance by online commercial giants, but it has been contending with internal problems and associations with drug dealers and hackers demanding ransoms in bitcoins.

- Companies are using ether’s computer network for computational services such as for monitoring raw material flows and surveilling trading transactions.

- The market places a higher value on the combined bitcoin and ether than on PayPal, and the digital currencies’ worth is closing in on that of Goldman Sachs.

Summary

The value of bitcoin, the leading virtual currency, rose more than 100% in the first six months of 2017. But its rival, ether, skyrocketed a mindboggling 4,500% over this same period. Ether coins outstanding had a market value of $34 billion as of mid-June, or 82% of the value of all the bitcoins available, compared to only 5% in January. Indeed, in the digital realm, things can change suddenly. And all this is happening without government regulation or corporate directives. Volunteers paid in the digital tokens create and sustain the currencies entirely on computer networks, and individuals trade them on private exchanges. Governance of these markets rests with investors and developers.

“The sudden rise of ethereum highlights how volatile the bewildering world of virtual currency remains, where lines of computer code can be spun into billions of dollars in a matter of months.”

Bitcoin, exclusively an electronic payment scrip, has established some legitimacy through its acceptance by online commercial giants like Overstock. But bitcoin also has been contending with technical issues and destructive feuding among its supporters, as well as harmful associations with drug dealers and hackers.

“Ethereum was designed to do much more than just serve as a digital money. The network of computers hooked into ethereum can be harnessed to do computational work.”

Ether, launched in 2015, has distinguished itself from bitcoin by extending its offerings beyond electronic money. Its network system, ethereum, is capable of running computational services, such as for “decentralized applications, or Dapps.” Major companies are creating computer programs on ethereum. For example, the startup Bancor wants to roll out other versions of virtual currencies, BHP Billiton is keeping tabs on its raw material flows and JPMorgan is surveilling trading transactions, all using ethereum. The Enterprise Ethereum Alliance, a nonprofit, has more than 100 corporate members building various management applications.

“Investors buying ether are placing a bet that people will want to use the ethereum network’s computing capabilities and will need to use the currency to do so.”

A June 2017 survey by CoinDesk, an industry publication, revealed that 94% of respondents were optimistic about ethereum’s prospects, while only 49% had a rosy view of bitcoin. Virtual currency watchers are waiting for ether to zoom past bitcoin in value, a moment they have christened “the flippening.” Some market participants anticipate that ether is bound to fall from its lofty valuations, following the pattern of bitcoin and other digital currencies, but ether continues its rise. Bitcoin and ether have taken what were once fringe currencies into the domain of big money. The market places a higher value on the combined bitcoin and ether than on PayPal, and the currencies’ worth is closing in on that of Goldman Sachs.

About the Author

Nathaniel Popper covers finance and technology for The New York Times.

This document is restricted to personal use only.

My Highlights

Did you like this summary?

Read the articleThis summary has been shared with you by getAbstract.

We find, rate and summarize relevant knowledge to help people make better decisions in business and in their private lives.

Already a customer? Log in here.

Comment on this summary