Book

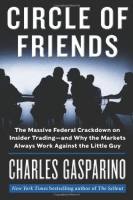

Circle of Friends

The Massive Federal Crackdown on Insider Trading – and Why the Markets Always Work Against the Little Guy

HarperBusiness,

2013

This summary is no longer available

We suggest you have a look at these alternatives:Related Summaries

Book

Book

Book

Book