Join getAbstract to access the summary!

Join getAbstract to access the summary!

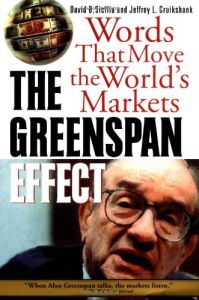

David B. Sicilia and Jeffrey L. Cruikshank

The Greenspan Effect

Words That Move the World's Markets

McGraw-Hill, 2000

What's inside?

When your economic survival depends on one man’s decisions, you’d better understand that man: How Alan Greenspan’s ideas and actions affect U.S. markets and your financial future (or... understanding the 500-pound gorilla).

Recommendation

David B. Sicilia and Jeffrey L. Cruikshank study how U.S. Federal Reserve Bank chairman Alan Greenspan interprets market forces. They explore how Greenspan’s thoughts and actions affect markets. Knowing Greenspan’s impact can be useful if you want to capitalize on market movements. The book examines the meaning – for investors – of Greenspan’s relationship with the markets. Along the way, the reader gets a whirlwind tour of the U.S. and world economies. The take-home message repeated again and again – Greenspan and interest rates can move markets – is something savvy investors might already know. getAbstract recommends this book to any investor who wants to understand the world economy better and to those who are interested, as investors or observers, in Greenspan’s impact on the markets.

Summary

About the Authors

David B. Sicilia, Ph.D., is a business historian, consultant, and author. He is the author or co-author of many books including The Engine That Could: Seventy-Five Years of Value-Driven Changes at Cummins Engine Company and The Entrepreneurs: An American Adventure. Jeffrey L. Cruikshank is the author of many business books, including the best-selling Do Lunch or Be Lunch. He is a co-founder of Kohn-Cruikshank, Inc., a communications consulting firm in Boston. Sicilia and Cruikshank previously collaborated on The Engine That Could.

Comment on this summary