Join getAbstract to access the summary!

Join getAbstract to access the summary!

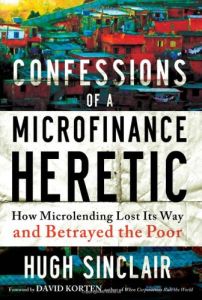

Hugh Sinclair

Confessions of a Microfinance Heretic

How Microlending Lost Its Way and Betrayed the Poor

Berrett-Koehler, 2012

What's inside?

Interest rates of 100% and heavy-handed repayment methods? Welcome to the world of microfinance.

Recommendation

In this well-sourced and highly readable memoir, investment banker Hugh Sinclair – who worked in the microfinance sector from 2002 to 2012 – offers a scathing indictment of how microfinance institutions (MFIs) really operate. His exposé arises from his experiences working deep inside the $70 billion microfinance industry and from his exploits traveling around the world for various MFIs and the funds that invest in them. In short, Sinclair knows what he’s talking about, and he has learned that the microlending world does not take warmly to criticism. He’s received numerous complaints from insiders that his relentless criticism borders on blasphemy and risks undermining any good the industry is doing for the poor. Sinclair even received a death threat for bringing this information to light. Though acknowledging that not all MFIs are guilty of injurious activities, getAbstract recommends this insightful but damning report to policy makers, regulators, activists, industry insiders, investors, and readers with an economic interest in microfinance and a social interest in addressing global poverty.

Summary

About the Author

Hugh Sinclair is an economist and investment banker. He worked in the microfinance industry for more than 10 years and now provides consulting services on microfinance strategy and portfolio management.

Comment on this summary

I am responding to you via email.

Thank you,

Julia