Join getAbstract to access the summary!

Join getAbstract to access the summary!

Catherine Dunn

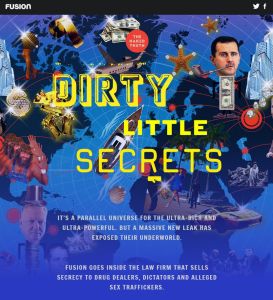

Dirty Little Secrets

Fusion, 2016

What's inside?

The Panama Papers investigation has opened a window into the shadowy world of shell companies and tax havens.

Recommendation

Investigative reporter Catherine Dunn explains how “registered agents” help drug lords, bank robbers and corrupt officials set up shell companies that conceal their assets. Dunn also shares the Panama Papers investigation’s intelligence on one of the worst offenders: the Panama-based legal firm Mossack Fonseca. This eye-opening exploration of one of the largest leaks in history exposes how the rich, corrupt and criminal really do business. In the interests of being fair and balanced, Dunn also reveals how easy it is to set up a shell company in the United States. While always politically neutral, getAbstract recommends this report to those concerned about the shadow economy.

Summary

About the Author

Catherine Dunn is an investigative reporter for Fusion.

Comment on this summary