Join getAbstract to access the summary!

Join getAbstract to access the summary!

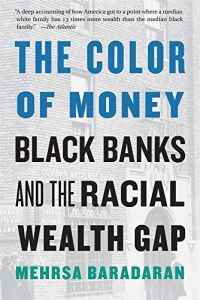

Mehrsa Baradaran

The Color of Money

Black Banks and the Racial Wealth Gap

Belknap Press, 2019

What's inside?

Black Americans have far less wealth than white Americans because the US economy is rigged.

Recommendation

An unequal playing field explains why Black Americans have far less wealth, higher unemployment and lower rates of homeownership than white Americans do. As the United States re-examines its racial gaps, professor Mehrsa Baradaran’s bracing book explores America’s fraught history. She delves into the US government policies that discriminated against Black Americans and the reforms that promised much but delivered little. Baradaran’s scathing analysis highlights how economic inequity lies at the root of systemic racism.

Summary

About the Author

Mehrsa Baradaran is a law professor at the University of California, Irvine. She is also the author of How the Other Half Banks.

Comment on this summary