1×

Log in to listen to the audio summary.

Recommendation

In January 2021, retail investors rallied to purchase the shares of GameStop, AMC and Blackberry, on which several Wall Street hedge funds held massive short positions. The buyers launched their offensive from the no-fee online trading platform Robinhood. The prolonged attack cost some hedge funds billions of dollars, and it nearly brought down Robinhood. In this compelling investigative article, New York Times journalists examine the purported Wall Street disrupter that nonetheless found itself at the mercy of the traditional financial system.

Summary

About the Authors

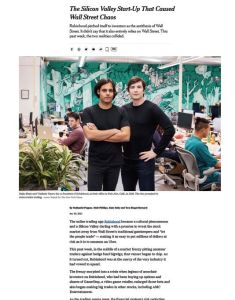

Nathaniel Popper et al. are journalists at The New York Times.

Comment on this summary