Join getAbstract to access the summary!

Join getAbstract to access the summary!

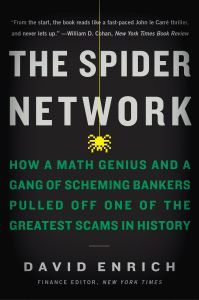

David Enrich

The Spider Network

The Wild Story of a Math Genius, a Gang of Backstabbing Bankers, and One of the Greatest Scams in Financial History

Custom House, 2017

What's inside?

The Libor scandal grew from a web of fraud that offers shocking insights into the life of a market trader.

Recommendation

Financial journalist David Enrich tells the true story of British trader Tom Hayes and his part in “the spider network” that fueled the infamous Libor scandal. The saga offers an unflattering exposé of the world of financial market traders and investment bankers. Enrich provides a visceral taste of what it’s like to work in finance, painting such a vivid picture of the incentives and the environment that you’ll almost feel sorry for the “carnivorous,” bonus-chasing, seemingly amoral bankers. Enrich shows that the trading culture abetted Hayes, who’s now in prison, and saved his bank bosses and associates – none of whom served a day in jail. Even if you don’t come to this tale already dubious about the trading activities of large investment banks, you will be plenty skeptical by its end.

Summary

About the Author

Now finance editor at The New York Times, David Enrich was the financial enterprise editor and European banking editor of The Wall Street Journal. He won the 2016 Gerald Loeb Award for his coverage of the Tom Hayes scandal.

Comment on this summary