Join getAbstract to access the summary!

Join getAbstract to access the summary!

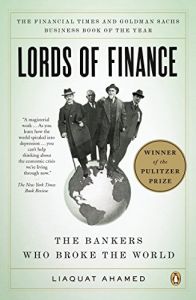

Liaquat Ahamed

Lords of Finance

The Bankers Who Broke the World

Penguin Group (USA), 2009

What's inside?

Bad luck did not cause the Great Depression. Four people were largely responsible for the era’s greatest economic crisis.

Recommendation

Who would have thought that a study of central bankers could be a page-turner? Investment manager Liaquat Ahamed spins a fast-moving yarn about central bankers’ disastrous monetary policy decisions in the 1920s and early 1930s. The story itself yields little suspense – you already know how it ends, but Ahamed uses thorough research and gripping detail to paint a complete picture of how the world economy collapsed. The Great Depression preceded today’s credit default swaps, collateralized mortgage obligations and arcane derivatives, so the book’s lessons for the modern crisis are mostly as referential cautions. getAbstract recommends this absorbing book to readers who want a deeper understanding of the gold standard, and the events that led to – and out of – the biggest economic crisis of the 20th century.

Summary

About the Author

Liaquat Ahamed has been a professional investment manager for 25 years. He worked for the World Bank, and now advises hedge funds and serves as a Brookings Institution board member. He holds economics degrees from Harvard and Cambridge.

Comment on this summary