Join getAbstract to access the summary!

Join getAbstract to access the summary!

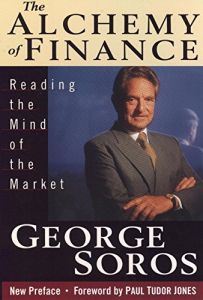

George Soros

The Alchemy of Finance

Reading the Mind of the Market

Wiley, 1994

What's inside?

George Soros offers a new way of looking at the markets and at everything you think you know about them.

Recommendation

This is a remarkable book by a remarkable man. Billionaire George Soros is one of the most notorious, successful speculators of the 20th century and one of the most freehanded philanthropists. Here he outlines a theory that leads to the conclusion that markets are not morally good, that the financial system is rigged to protect the interests of the rich and powerful, and that economics is a spurious science. Much can be said in criticism of this book. It is replete with logical fallacies, muddies the arguments of those with whom the author disagrees, sets up straw men, and does not take adequate account of work done by philosophers and psychologists in some of the areas the author explores. But, getAbstract finds that there is also a great deal of good that can be said. Soros is an original thinker, at his best when he is talking about his own direct experience. He is straightforward about how his ideas have changed, and about his trading and forecasting errors. And why shouldn’t he be, when, as he says, his errors are the keys to his success?

Summary

About the Author

George Soros chairs Soros Fund Management, the principal investment adviser to the multibillion-dollar Quantum Group of Funds. His charitable foundations give nearly half a billion dollars annually in 50 countries for projects in education, public health, civil society development, human rights and other areas.

Comment on this summary

This work is unique and innovative in Finance. Mr Soros does not agree with classical economics ideas in Market.

Markets are amoral by nature as people's understanding of nature's are based in fantasies.

Soros sees the markets from other scope.

The plinciple of ucertainty, similar to

Von Klasuwitt's frictions.

Scapiing Nazi Concentration Camps, he graduated from LSE and arrived in New York.

Starting a successful career.

Soros Quantum Fund obtained astronomical returns for its imvestos, catapulking Mr Soros as one of great Investors beside Warren Buffet or Ray Dalio.

This book is real treasure to everyone who wants to understand HOW WORKS THE MARKET.