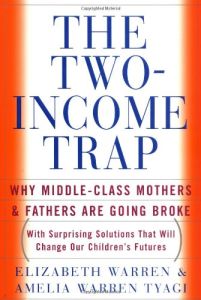

The Two-Income Trap

Why Middle-Class Mothers and Fathers are Going Broke

Recommendation

Mother-and-daughter authors Elizabeth Warren and Amelia Warren Tyagi tell the frightening tale of a rising tide of bankruptcies and financial difficulties in middle-class America. Their statistics show that families with children, including single parent families, are hardest hit by this epidemic. The authors, who make no pretence of objectivity, blame corporate greed and government neglect. Their politically improbable proposals include school vouchers removing geography as a placement criteria and the re-regulation of lending. The book doesn’t ever really define its pivotal audience, the "middle class." It trusts your conventional wisdom about what it means to be middle-class, while passionately questioning conventional wisdom about consumer debt. Yet, despite the book’s flaws, the authors make a thought-provoking, eye-opening argument about lending practices and they issue clear warnings about debt. getAbstract.com recommends this book to families, and to anyone concerned about social justice, family-friendly policies and consumer debt.

Summary

About the Authors

Elizabeth Warren, a professor at Harvard Law School, is the co-author of As We Forgive Our Debtors and The Fragile Middle Class. She is vice-president of the American Law Institute, and served as Chief Advisor to the National Bankruptcy Review Commission. Amelia Warren Tyagi was a McKinsey & Company consultant, specializing in health care, insurance and education. She co-founded HealthAllies, a healthcare company.

Comment on this summary